Why I Didn't Buy the Kaspa Dip (My Data Said NO)

In the last few weeks, the Kaspa market gave us a masterclass in volatility. A sharp, fear-inducing dip was followed by a rapid, FOMO-inducing recovery. For many, this V-shaped bounce felt like a missed opportunity, a frustrating moment of hesitation.

My inbox saw the questions: "Did you buy the dip?" "Was that the bottom?"

My answer is no, I didn't buy. And this wasn't a guess or a failure of nerve. It was a deliberate, data-driven decision. The most important one an investor can make is knowing when to say "no."

This post will break down the exact data I used to make that call, showing how a quantitative framework can be a fortress against the costly emotions of fear and FOMO.

The Allure of FOMO: The Market's Oldest Trap

The "Fear of Missing Out" is a powerful psychological force. It pushes us to chase green candles and make reactive decisions based on what we fear might happen next, rather than what the data suggests is probable. Acting on FOMO is the fastest way to compromise a long-term strategy.

My entire approach is built on a single premise: Discipline is the only long-term alpha. And discipline requires a system—an objective framework that can override emotional impulses. My framework is the Power Amplitude Index (PAI).

The Power Amplitude Index (PAI)

The PAI is a proprietary tool I developed to quantify the historical opportunity present at a given price. It analyzes an asset's price action and tells me how "overheated" or "oversold" it is relative to its own history.

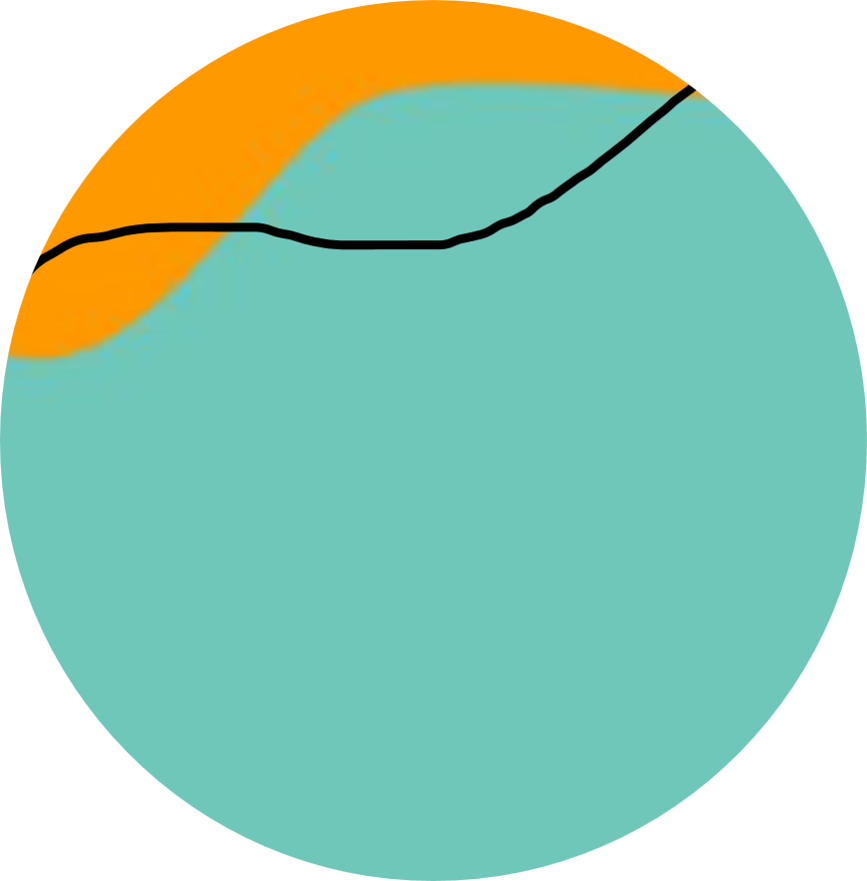

Here is the complete PAI dashboard for Kaspa as of mid-August 2025

The colors tell a simple story: blue and green zones represent historically better buying opportunities (lower risk), while orange and red zones represent historically worse times to buy (higher risk).

When the price of Kaspa dipped to around 8 cents, the PAI value certainly became more attractive. But "more attractive" isn't good enough. My strategy, the Patient Hunter Protocol, demands an asymmetric opportunity.

The 20% Rule: A Deeper Look at the Data

To define what an "asymmetric opportunity" truly is, I use the PAI Cumulative Distribution chart (the bottom bar chart in the image).

This tool shows what percentage of time Kaspa has spent within each PAI zone. Here's how to read it:

Dark Blue (0.0-0.1 PAI): Kaspa has only been in this "once-in-a-cycle" zone 5.7% of its life.

Blue (0.1-0.2 PAI): It has spent 12.7% of its time here.

My protocol is simple: I only deploy significant capital when the PAI is in the bottom 20% of all historical readings. By adding the two lowest zones together (5.7% + 12.7%), we see that this 20% threshold corresponds to a PAI value of 0.2 or lower.

During the recent dip, the PAI never crossed below this 0.2 threshold. The data was sending a clear signal: "This is a good opportunity, but it is not yet a great one."

The Power of a "NO" Signal

By sticking to the 20% rule, the system did its most important job: it protected my capital from a "good enough" trade. The goal is not to catch every bounce. The goal is to deploy capital with the highest possible probability of a Power Law-style return.

Missing a 20% price gain is irrelevant if it means preserving capital and discipline for a future 100x opportunity. Adherence to the process is more valuable than the outcome of any single trade.

Watch The Full Video Breakdown

I walk through this entire analysis, chart by chart, in my latest video. You can see the full breakdown here:

The Path Forward

My stance on Kaspa remains unchanged. I am a patient hunter, and my capital is waiting for the signal I require. The data, not the market's mood, will dictate my next move.

When the PAI tells me we have entered that rare, sub-0.2 zone of maximum opportunity, I will be ready to act with conviction. Until then, I am comfortable waiting.---

Want to get these insights before they hit YouTube?

Join my free newsletter at powerlawinvestor.com for my most direct, exclusive analysis and updates on the PAI.