TAO’s “Absolute Zero” Moment: Why I Prefer PAI Trend-Following Over Bottom-Catching

Supporting article for the video: https://youtu.be/b_8V_KZ4djo

Last updated: 2026-02-16

Executive Summary

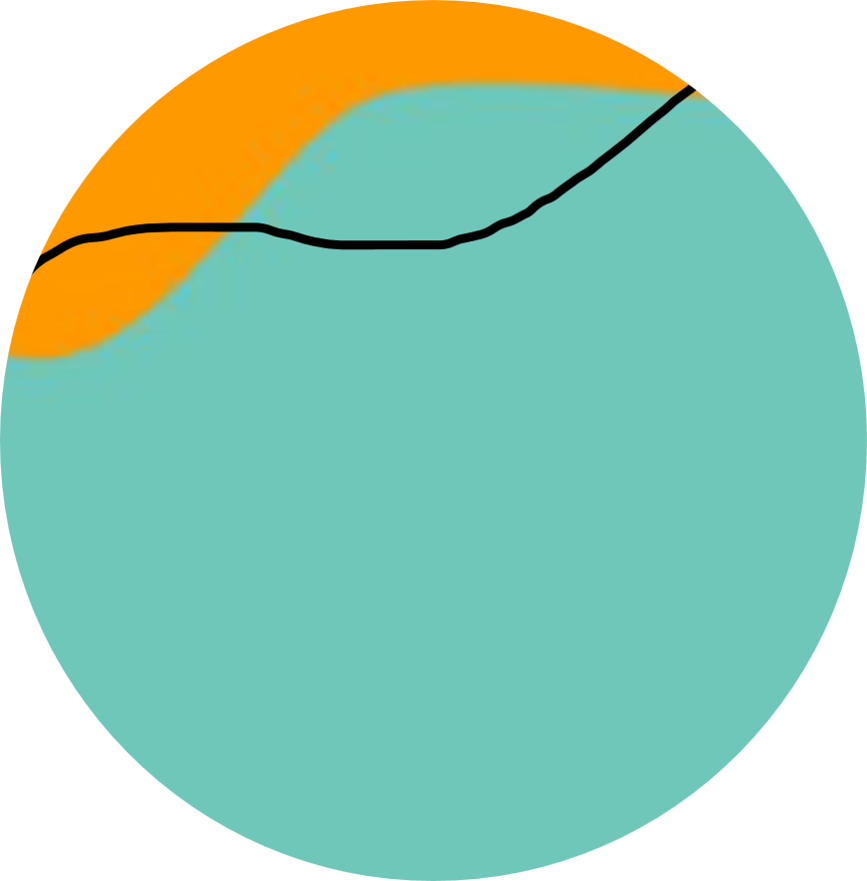

- What I said (Feb 4): TAO’s Power Amplitude Index (PAI) was 0.239, and the model’s implied PAI=0 price level was ~$159 (i.e., “around $160” looked like a statistical floor at that time).

- What happened (Feb 11): TAO printed a local low around $144, and the PAI value hit 0.00 (maximum oversold conditions).

- What matters: Catching bottoms can feel great, but it’s also one of the easiest ways to get wrecked without proper risk management

- My preferred tactic: A trend-following approach using the 0.5 PAI crossover tends to be more risk-adjusted in choppy / bear-leaning conditions.

- The level I’m watching: the current PAI 0.5 “transition price” is around $215. I’m looking for a break above that zone to confirm positive momentum.

Part 1 — Anatomy of a Bottom (and why the “floor” moved)

The Power Amplitude Index (PAI) is designed to be causal: it does not “repaint” historical signals. Each day’s PAI reading is computed using only information available up to that day.

On Feb 4, TAO’s PAI sat at 0.239, and the model’s implied PAI=0 price level was about $159. That’s why I called ~$160 a high-quality zone to start paying attention.

Then the market kept falling. By Feb 11, TAO printed a local low around $144, and the PAI reading hit 0.00 (what I call “Absolute Zero”—maximum oversold conditions in this framework).

Part 2 — Ex-Ante Check (the day before the low)

One of the most important credibility tests for any indicator is: What did it say before the move completed?

On Feb 10 (one day before the local low):

- Price was about $154.58

- PAI was about 0.045 (deep oversold)

- The implied PAI=0 price level was about $148

The next day, TAO tagged the local low around $144.

This is not “perfect precision,” and it’s not a guarantee. But it is directionally useful: the model was already signaling “deep cold” and pointing to a lower implied floor before the final flush.

Important: Why the “floor” can drift

The “PAI=0 price level” is recalculated each day. As the trend/variance of the price path evolves, the implied price levels can move.

Part 2 — The problem with “catching the knife”

If you bought TAO at the low, congrats—you nailed it. But there are two structural problems with bottom-catching:

1) The “falling elevator” risk

An asset can sit in very low PAI zones (0.0–0.1) and still grind lower or stay ugly for longer than you can stay confident.

Even when the model is screaming “oversold,” the market can keep punishing you.

2) The exit dilemma

A “perfect entry” creates psychological pressure:

- Do you sell the first bounce?

- Do you hold for the full recovery?

- Do you panic when it chops sideways?

Paradoxically, “perfect entries” often lead to imperfect exits.

So yes—PAI=0 can be a powerful signal, but “buying Absolute Zero” is not automatically the best strategy for most people.

Part 3 — The superior strategy (in this market): Trend Following

This is why I prefer a trend-following tactic right now.

Instead of trying to be a sniper at the bottom, I’d rather be a trend follower who pays an “insurance premium” for confirmation.

The rule

We use the 0.5 PAI crossover:

- BUY: when PAI crosses up from below 0.5 to above 0.5

- SELL: when PAI crosses down from above 0.5 to below 0.5

This usually means you miss the first 10–15% of a move. That’s the premium.

In return, you reduce exposure to prolonged downtrends and “dead-cat bounces.”

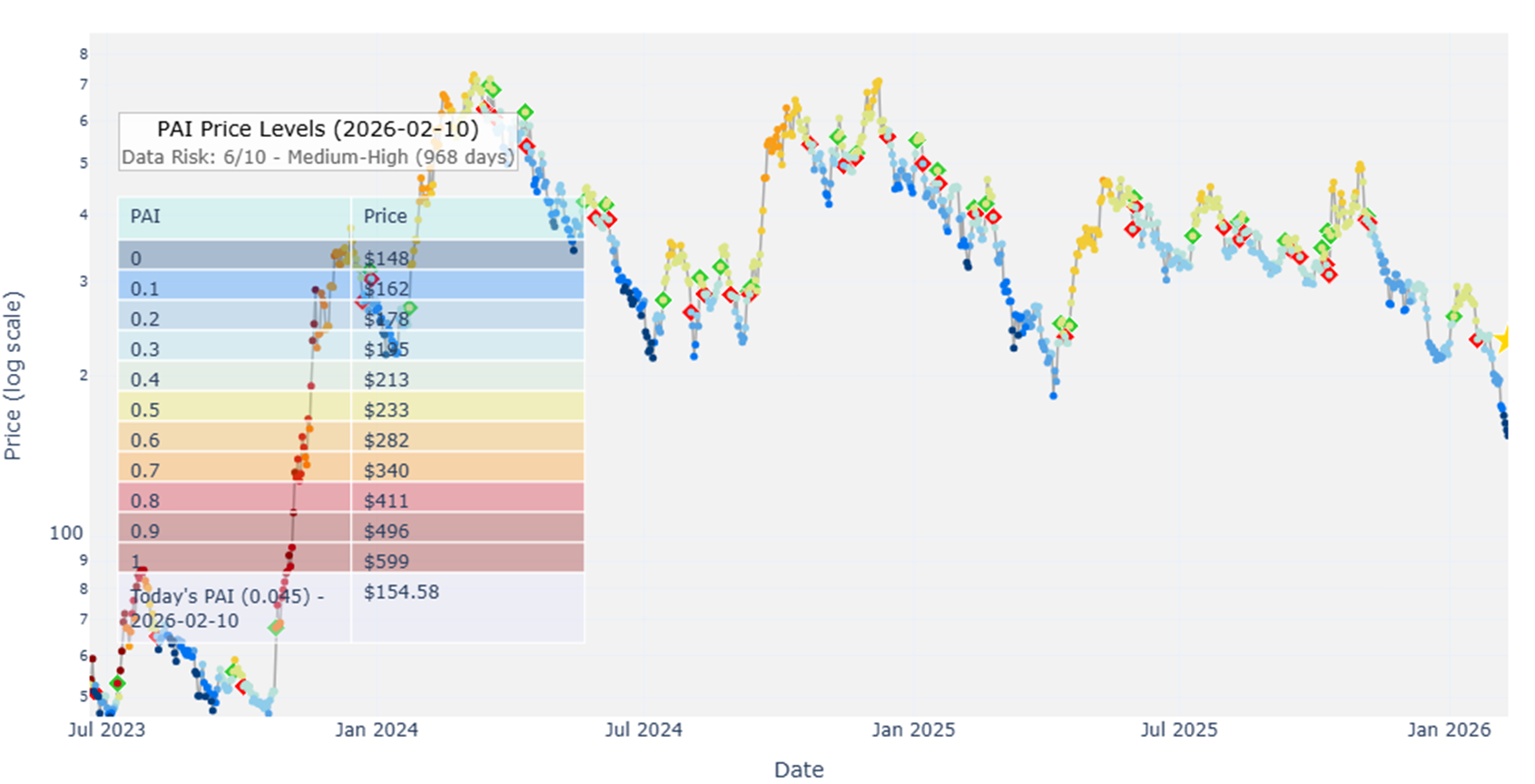

Part 4 — Strategy vs Buy & Hold (why risk-adjusted matters)

I ran a rules-based historical simulation of the 0.5 crossover strategy on TAO, using daily data beginning in January 2024.

- Trend-Following (0.5 crossover): +23%

- Buy & Hold: -30%

The point isn’t that +23% is “moon math.”

The point is capital preservation: the strategy avoided major drawdown periods that damaged buy-and-hold performance.

Figure 3: Strategy performance (blue) vs Buy & Hold (green).

Backtest assumptions

Timeframe: 1D (daily)

Signal timing: computed on the daily close

Execution: next-day open

Fees/slippage: Not included

Conclusion — The level to watch

As of Feb 16, 2026, TAO’s PAI is roughly 0.36. That puts it in a recovery zone, but not yet in confirmed uptrend territory.

The current PAI 0.5 “transition price” is around $215.

Until price/PAI breaks back into confirmed trend territory:

- I’m not trying to be hyper-active

- I’m trying to be positioned with the trend

Because the goal isn’t to trade a lot.

The goal is to be right.

Disclosures

This is not financial advice. Crypto is volatile. Models can fail, regimes can change, and drawdowns can be severe. Use position sizing and risk management appropriate for your situation.