Kaspa PAI

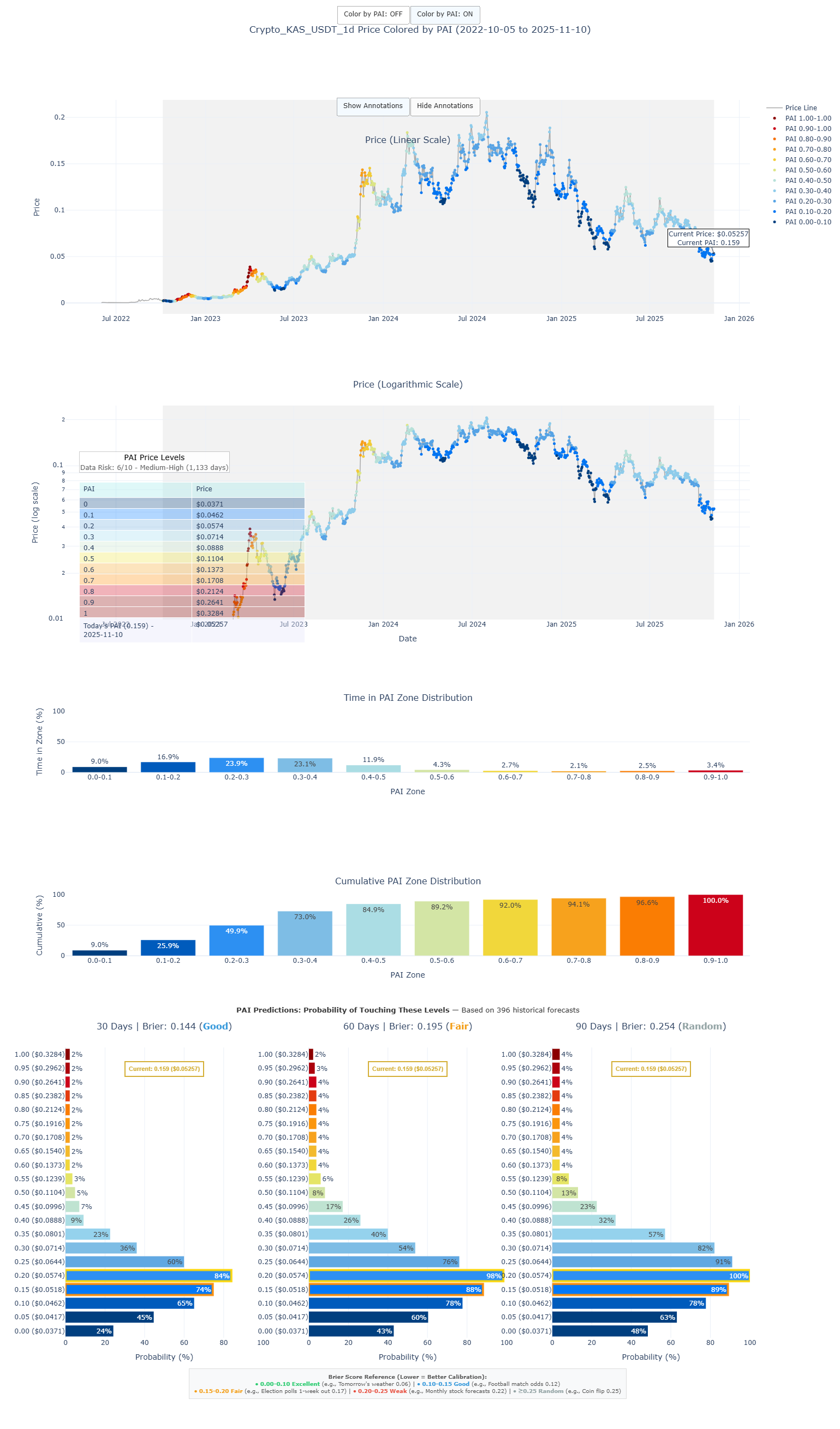

Kaspa PAI (Power Amplitude Index) & Probability Outlook

The Power Amplitude Index (PAI) measures where Kaspa’s price sits relative to its own historical behavior. Instead of asking, “Is price going up or down?” PAI answers a more useful question:

Is Kaspa currently expensive or cheap relative to its history?

This matters because price tends to behave differently in different regions:

| PAI Range | Interpretation | Typical Market Behavior |

|---|---|---|

| 0.0 – 0.2 | Historically Cheap | Accumulation, favorable entry conditions |

| 0.4 – 0.6 | Mid-Range | Chop, ranging behavior, little directional edge |

| 0.8 – 1.0 | Historically Expensive | Distribution, profit-taking, mean reversion risk |

PAI is calculated using no look-ahead bias — meaning the model never uses future price data. This preserves causality, prevents hindsight distortion, and makes the signal reliable in forward use.

Current Kaspa Positioning (Latest PAI Composite Chart)

How to Read the Chart Above

This chart compresses four layers of analytical insight:

-

Price Colored by PAI

Shows whether current price is in a historically cheap (blue) or expensive (red/orange) region. -

Time Spent in Each PAI Zone

Reveals where KAS tends to live historically.

Kaspa spends most of its time below PAI 0.3 → meaning current levels are normal accumulation conditions, not anomalies. -

Cumulative Zone Distribution

Shows how far into historical structure each zone extends — how deeply price tends to reach. -

Probability Forecasts (30 / 60 / 90 Days)

Displays the likelihood of price touching key levels within different time horizons.

Touch-level probabilities are stable and statistically measurable — unlike price predictions.

Taken together, the chart acts as a market weather report:

It does not predict the future — it tells us where conditions favor patience vs aggression.

Probability Outlook (30 / 60 / 90 Days)

The most actionable component of this framework is the touch probability forecast.

- Kaspa is currently in a low PAI zone (~0.15–0.20).

- Historically, this aligns with accumulation, not breakout continuation.

- The model shows a higher probability of retesting lower value zones (~$0.04–0.046).

- The probability of immediate upside continuation is lower by comparison.

Execution Implication

The edge here is in patience.

Use limit buys, not emotional market buys.

Practical Positioning Framework

| Market Condition | Expected Behavior | Best Action |

|---|---|---|

| PAI 0.0–0.2 | Structural value & accumulation regime | Scale in gradually with limit orders |

| PAI 0.3–0.6 | Drift, chop, no structural edge | Do nothing / hold positioning |

| PAI 0.7–1.0 | Distribution pressure, mean reversion | Scale out / risk manage |

This framework is designed to remove emotion from execution and replace it with statistical advantage.

How This Fits Into the Larger Framework

PAI shows where we are in the cycle locally, but does not show where we are globally.

To understand broader macro-cycle positioning, we combine PAI with the Bitcoin Power Law Model:

| Model | Purpose |

|---|---|

| Power Law | Defines long-term structural trajectory / cycle context |

| PAI | Defines short-term value zones and execution timing |

Together, they create a complete directional + execution system.

Read the full integrated explanation here:

https://powerlawinvestor.com/pai-guide/

Get Weekly Updated Probability Dashboards

If you want the latest 30/60/90-day touch probabilities for Kaspa, Bitcoin, and Fartcoin delivered weekly:

Get the Weekly Probability Dashboard (Free):

https://powerlawinvestor.com