How a "Patience" Signal on Kaspa Led to a Major Discovery in Ethereum

The crypto market never sleeps, and the urge to constantly "do something" can be overwhelming. But a data-driven approach requires discipline. Sometimes, the most profitable action is inaction.

Right now, my proprietary Price Action Indicator (PAI) for Kaspa ($KAS) is giving a clear signal, but it's not the exciting "buy" signal many might be hoping for. It's a signal for patience.

This lack of clear opportunity in a familiar asset is what forces a good analyst to broaden their search. It's what pushed me to stress-test my model on a new frontier: Ethereum ($ETH). What I found was a major validation of the entire system and a critical step in building a true multi-asset risk engine.

In this analysis, I'll break down the current verdict on Kaspa and show you the powerful preliminary results the PAI model has uncovered in Ethereum's chart.

(If you prefer to watch, you can see the full breakdown in my latest video analysis below):

https://www.youtube.com/watch?v=Bz7nphGcP3M

Our Foundation: A Two-Layer System

Before we dive into any single asset, it's critical to understand the foundation of our methodology. We use a Two-Layer system to navigate the market:

- Layer 1 (The Macro Framework): We use Bitcoin's Power Law to understand the overall market regime. Is the entire crypto ecosystem in a risk-on bull phase, a risk-off bear phase, or a neutral accumulation zone?

- Layer 2 (The Tactical Tool): Only when we have the macro context do we deploy the Price Action Indicator (PAI) on individual assets to identify historically low-risk moments for accumulation.

This system ensures we're not making tactical trades against a powerful macro tide.

The Kaspa Verdict: The Data Demands Patience

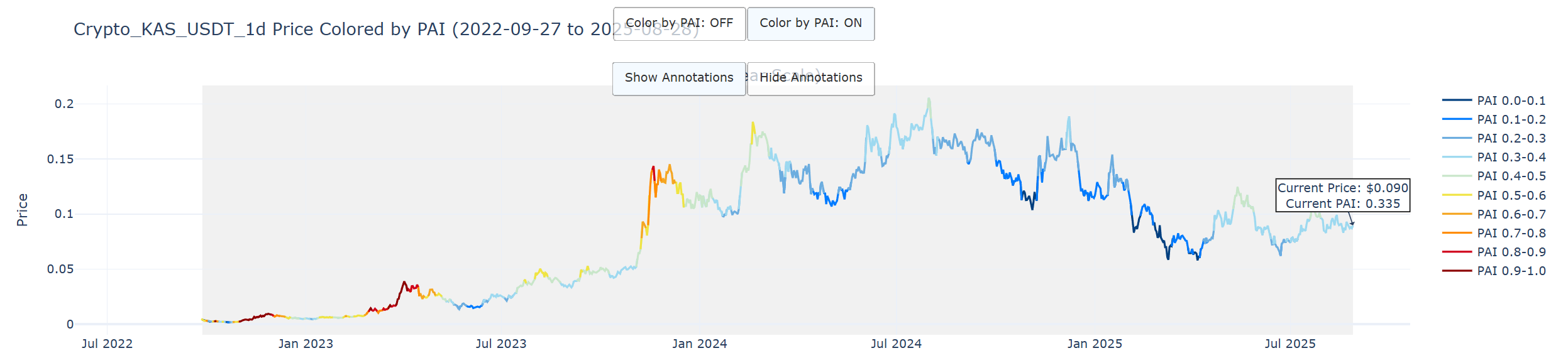

As of today, Kaspa is trading at approximately $0.090. Let's look at what the PAI is telling us.

The PAI is a risk metric that is normalized from 0 (historically lowest risk) to 1 (historically highest risk). For Kaspa, my backtesting has shown that the "dark blue" zone, a PAI reading between 0.0 and 0.2, has consistently represented the highest-conviction opportunities to accumulate.

Today, the Kaspa PAI is at 0.335. This puts us in the "light blue" zone—a significant distance from our prime accumulation target.

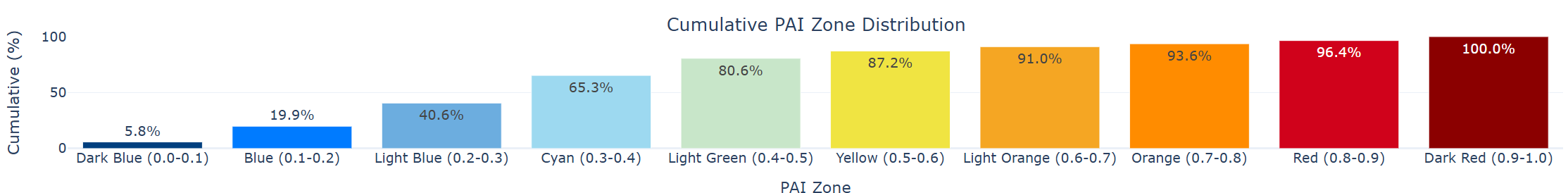

To put this in perspective, we can look at how much time Kaspa has historically spent at different PAI levels.

The data shows that Kaspa has historically traded with a PAI below 0.2 about 19.9% of the time. My personal framework is to target entries within this bottom 20% zone. At 0.335, we are simply not there yet. The data's verdict is clear: this is a time for patience, not aggressive buying.

The Strategic Pivot to Ethereum

With a clear "hold" signal on Kaspa, the logical next step for any analyst is to ask: where else might there be opportunity? A robust model must be able to perform across different assets. This led me to begin the rigorous process of calibrating and backtesting the PAI model on the king of altcoins: Ethereum.

The Discovery: The Ethereum PAI is Validated

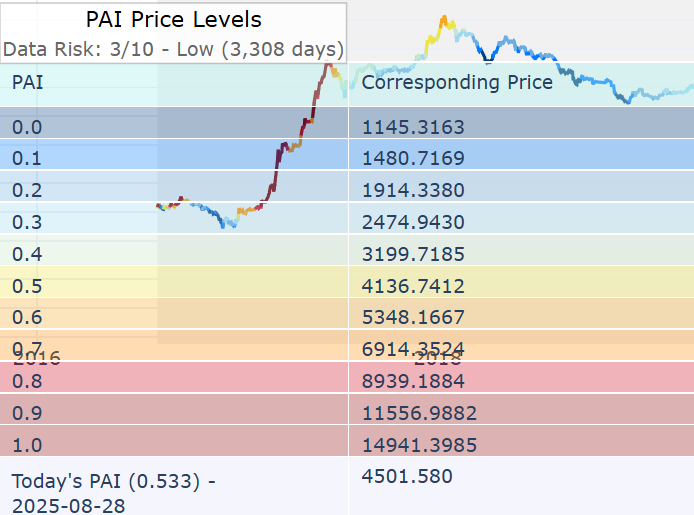

The results of this initial test were nothing short of a breakthrough for our system. While the current Ethereum price of ~$4,501 gives us a PAI of 0.533 (the "yellow" zone, indicating moderate risk), the real story is in the historical data.

The PAI model, when applied to Ethereum's entire price history, proved to be incredibly effective at identifying major market bottoms and generational buying opportunities.

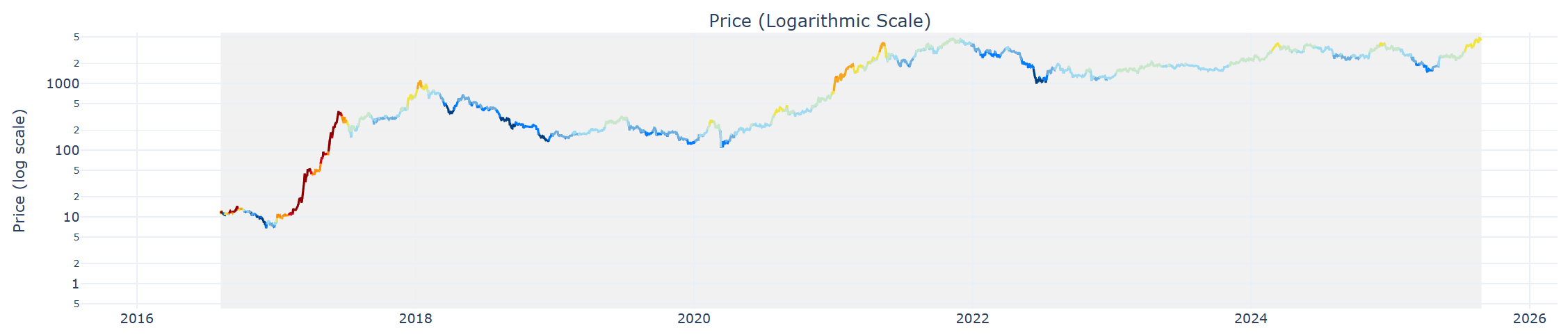

As you can see on the logarithmic chart, the deep blue "Max Opportunity" zones align perfectly with the 2018 bear market bottom, the 2020 accumulation phase, and the 2022 lows. The model successfully filtered the noise and pinpointed moments of maximum historical opportunity.

Looking at the specific price levels associated with these signals is even more compelling.

This initial backtest validates the core PAI methodology on a completely different asset with a much longer history than Kaspa. It's a critical proof-of-concept.

The Path Forward: Building the Risk Engine

The verdict from our data is clear: Patience on Kaspa, Validation on Ethereum.

We now have two assets being actively monitored by the PAI system, with the Bitcoin Power Law acting as our overarching macro guide. The successful validation of the model on Ethereum is a major step in evolving this project into a true multi-asset risk engine.

The next step is a full deep-dive into the Ethereum model. What are its specific parameters? What price levels correspond to a "buy" signal today?

If you want to get that analysis the moment it's released, the best way is to join my free newsletter. You'll join other data-driven investors in getting my latest insights delivered directly to your inbox.