BitTensor (TAO): The Quantitative Case for Patience

Asset: BitTensor (TAO)

Current Price: ~$190

Market Bias: Bearish / Caution

The crypto market is currently a landscape of noise and emotion. With Bitcoin hovering just below $76,000 and altcoins like BitTensor (TAO) seeing significant pullbacks, the "buy the dip" narrative is in full swing across social media.

I do not invest in narratives. I invest in validated probabilities. Today, the data suggests that while the long-term potential for TAO remains, the immediate path forward requires disciplined patience.

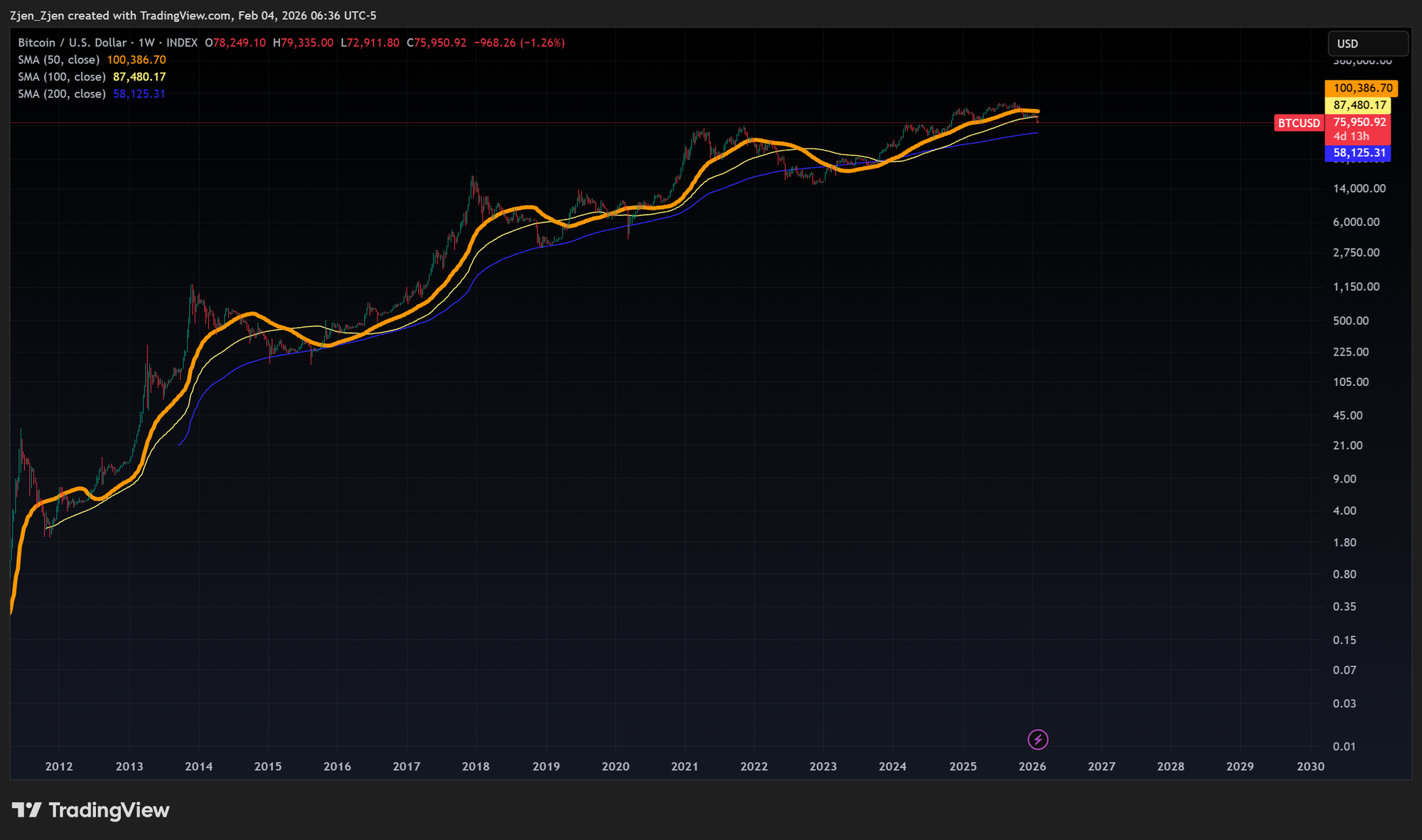

1. The Macro Anchor: Bitcoin's "Date with Destiny"

To understand BitTensor, we must first understand the "King." Bitcoin currently dictates the regime for the entire asset class. By analyzing the weekly Simple Moving Averages (SMA), we see a historical "waterfall" pattern that is currently playing out.

Historically, crossing below the 50-week SMA (orange) signals the start of a bear regime. Once that line is lost, price typically "smashes through" the 100-week SMA and finds its ultimate floor at the 200-week SMA (blue), although it may dip lower as in 2022.

Currently, this 200-week SMA sits at approximately $58k–$60k. Until Bitcoin reaches this "date with destiny" OR reclaims the 50-week SMA (~$100k), we must assume the macro trend is down.

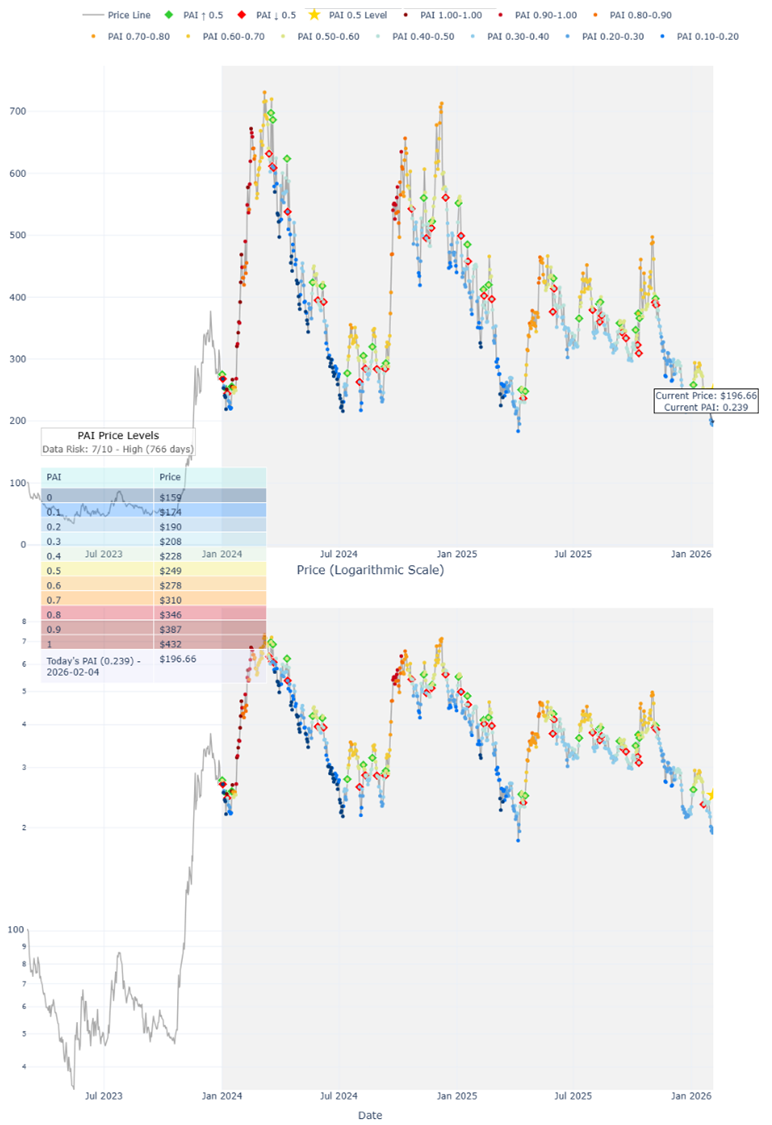

2. BitTensor and the Power Amplitude Index (PAI)

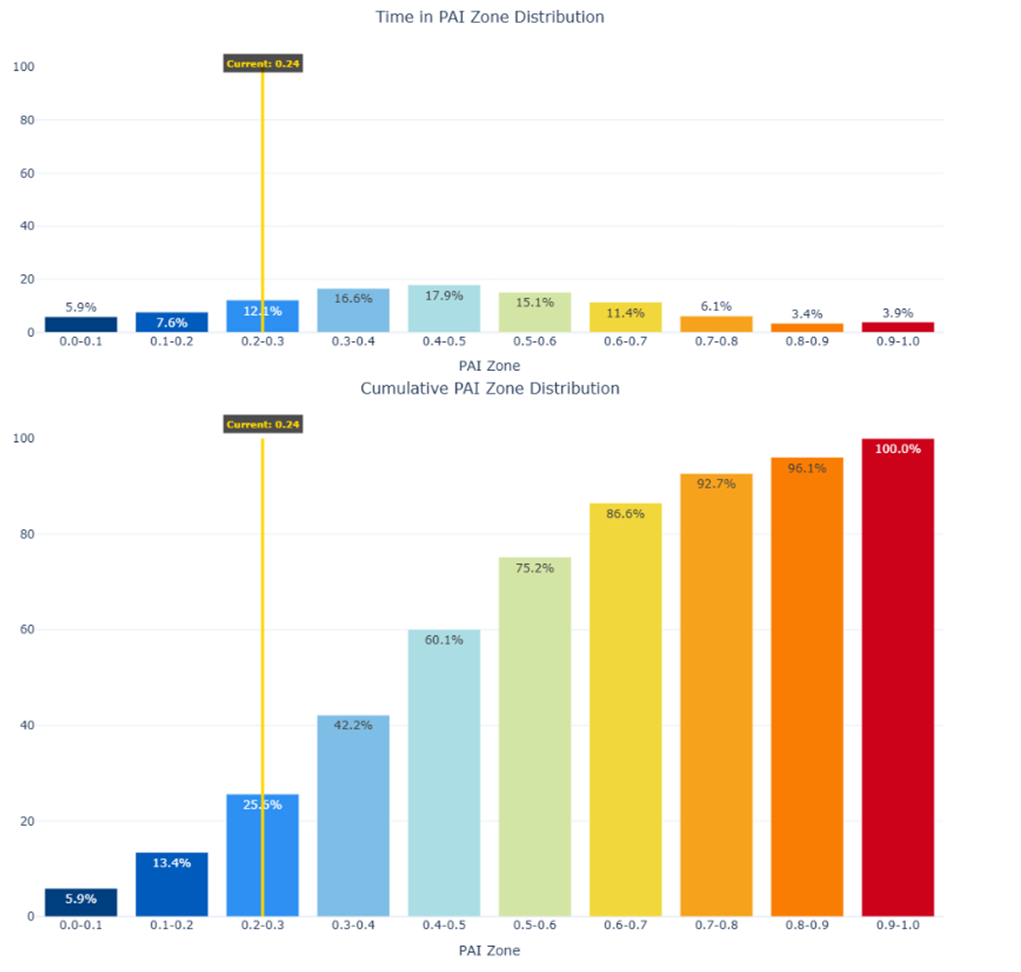

BitTensor is currently trading around $190. To the average observer, this looks like a "cheap" entry. But "cheap" is a relative term. Using the Power Amplitude Index (PAI)—a proprietary metric that scales from 0 to 1 based on an asset's unique history—we can quantify exactly how "blue" (oversold) we are.

TAO’s current PAI is 0.239. This puts us in a zone where the asset has only spent about 25% of its history. While this is historically "blue," the PAI can remain low for extended periods if we are in a bear regime. Our downside risk to the absolute historical floor (~$160) is roughly 20-25%, while the upside potential remains vast ($430).

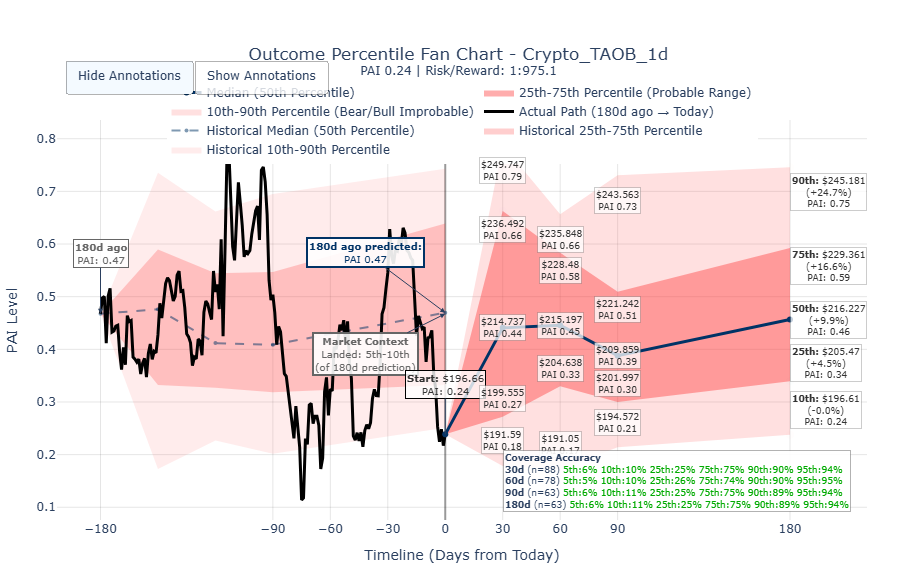

3. Regime Detection: The Fan Chart Proof

The most compelling piece of evidence for caution is our Outcome Percentile Fan Chart. This chart compares the predicted path of the PAI from 180 days ago against the actual price action we've seen today.

180 days ago, the median PAI prediction for TAO was 0.44. Instead, we have plunged into the bottom 10th percentile of historical outcomes. This is a mathematically rigorous confirmation of a Bear Market. In this regime, "screaming buys" can quickly become "falling knives".

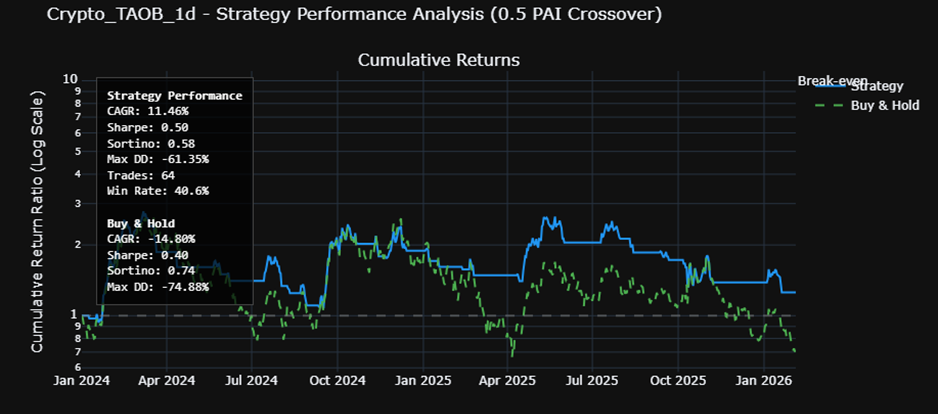

4. The 0.5 PAI Strategy: Backtesting Discipline

Because we cannot predict the absolute bottom, we use a Reactive Strategy rather than a predictive one. The 0.5 PAI Crossover Rule is simple:

- Buy when the PAI crosses above 0.5 (Confirming momentum).

- Exit when the PAI crosses below 0.5 (Protecting capital).

When we backtest this against a "Buy & Hold" strategy for TAO since early 2024, the results are clear:

| Strategy | Return | Max Drawdown |

| Buy & Hold | -27% | -74.88% |

| 0.5 PAI Strategy | +25% | -61.35% |

For example, the 0.5 PAI strategy allowed investors to exit the market in February 2025, shielding them from the losses the "holders" endured.

Summary and Action Plan

We are not in a market that rewards bravery; we are in a market that rewards capital preservation. My plan for BitTensor is as follows:

- Current Stance: Bearish/Neutral. No current position.

- The Trigger: I am waiting for a PAI crossover above 0.5, which currently aligns with a price of roughly $250.

- The Macro Condition: I remain cautious on all alts until Bitcoin reclaims the 50-week SMA or finds support at the 200-week SMA (~$60k).

Preserve capital now. Multiply it later.