BitTensor (TAO): The "Momentum" Case for 2026

Date: January 4, 2026

Happy New Year. As we kick off 2026, the crypto market is presenting us with a textbook decision point. Today I want to focus on BitTensor (TAO), which is trading at roughly $259.

We are currently seeing a specific signal on the Power Amplitude Index (PAI) that forces us to choose between two distinct investing philosophies: do we wait for the "perfect" bottom, or do we respect the momentum?

Let's look at the data.

The State of the Network

First, let’s ground ourselves in the proprietary metric I use for these analyses: the Power Amplitude Index (PAI).

For new readers, the PAI is a causal index—meaning it has no look-forward bias. It "learns" as time goes on, using only historical data to determine if an asset is overheated (Red/High PAI) or undervalued (Blue/Low PAI).

As you can see in the chart below, TAO has historically offered clear buy zones in the deep blue and sell zones in the red and dark orange.

Right now, we are sitting at a PAI of 0.51. We are no longer in the "deep value" blue zone, but we aren't overheating yet either. We are exactly in the middle.

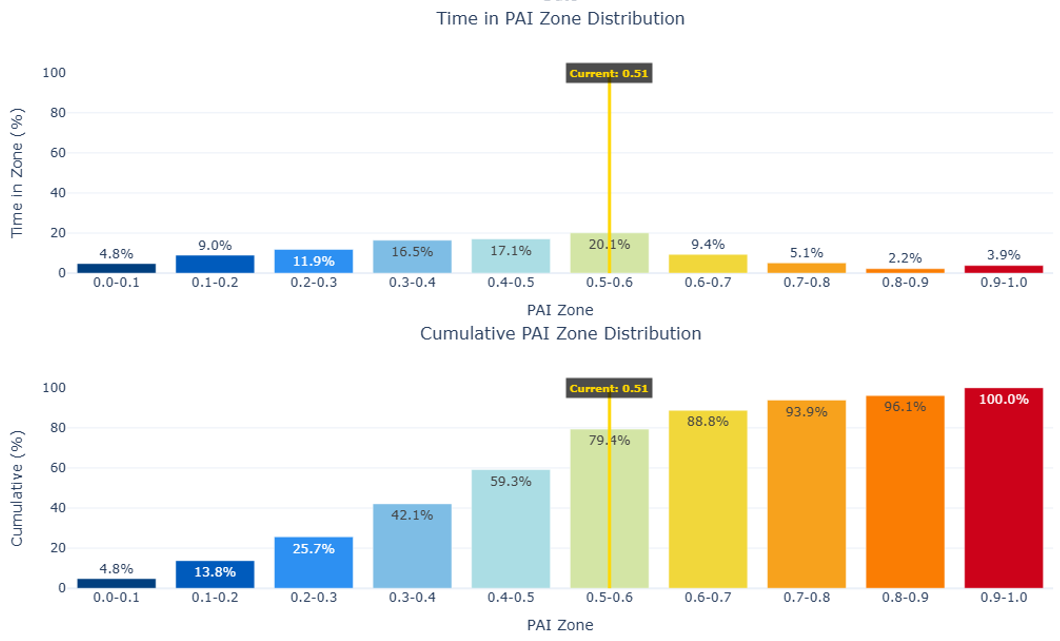

The Probability Distribution

To understand what a PAI of 0.51 actually means for our probabilities, we need to look at the historical distribution. How often does TAO stay this cheap?

The histogram below shows the "Time in Zone." Historically, TAO has spent about 60% of its life at a PAI lower than where we are today.

This data presents a dilemma. If you are a strict Mean Reversion investor (buying only the cheapest ~10% of days), you would be sitting on your hands right now, waiting for a drop back to the ~$190 range. But the market doesn't always give us the perfect entry.

This brings us to the second, and perhaps more relevant strategy for 2026: Momentum.

The Case for Momentum (The 0.5 Crossover)

In a roaring bull market, you can afford to buy and hold anything. But as I’ve noted recently, we have to be cautious of broader bear market structures. In uncertain times, "identifying the bottom" is risky because the bottom can always drop out.

Instead, we can use a Momentum Strategy: buying when the asset proves strength by crossing the 0.5 PAI threshold, and selling if it drops back below it.

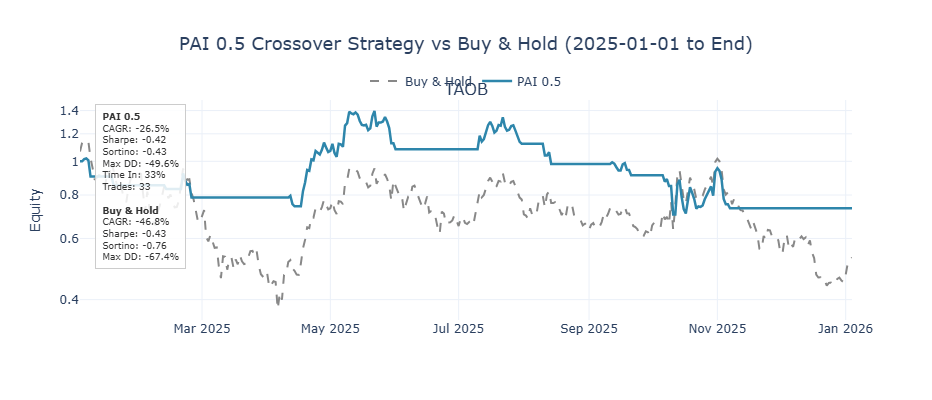

Does this actually work? I backtested this specific strategy—buying the 0.5 PAI crossover vs. a standard "Buy & Hold"—throughout the difficult chop of 2025. The results were stark.

As the equity curve shows:

- Buy & Hold would have turned $1.00 into $0.52 (a ~48% drawdown).

- The PAI Crossover Strategy preserved capital, turning $1.00 into $0.73.

While a loss is never the goal, the PAI strategy outperformed Buy & Hold by nearly 40% simply by keeping you out of the market during weak downtrends. It flattened your risk curve.

The Trade Setup

We have just crossed that critical 0.5 PAI threshold (roughly $254).

If you believe the AI crypto narrative is heating up for 2026, this is a technically valid entry point. You are not buying the bottom, but you are buying confirmed momentum.

The Rules for this Trade:

- Entry: Current levels ($258 range), as we are above the 0.5 PAI signal.

- The Buffer: To avoid getting "chopped" out by daily noise, I recommend using a 2% buffer. Don't sell the second it touches the line; give it 2% breathing room.

- The Stop Loss: This is a two-way street. If TAO drops back below the 0.5 PAI level (minus your buffer), the momentum thesis is invalidated, and the strategy dictates a sell.

This approach won't catch the absolute bottom or the absolute top. But as the equity curve proves, catching the "middle 60%+" of the move—while avoiding the catastrophic drops—is how you survive and thrive in a complex market.

Disclaimer: This is not financial advice. I am sharing my quantitative research for educational purposes. Always do your own due diligence.