BitTensor is Flashing "Buy." Here's Why I'm Waiting.

Date: December 18, 2025

Asset: BitTensor (TAO)

Price: ~$230

BitTensor (TAO) sits at the nexus of the two most powerful narratives in technology: Crypto and Artificial Intelligence. The long-term story is incredibly compelling.

However, as a data-driven investor, I do not invest in narratives. I invest in probabilities.

Right now, my proprietary Power Amplitude Index (PAI) is flashing a "Blue" signal—historically a strong buying opportunity. Yet, despite this signal, I currently hold zero position in TAO.

In this market environment, blindly following a value signal can be a trap. Today, I am breaking down the data behind why I am ignoring the "Buy" signal for now, and the two specific triggers I am waiting for before I deploy capital.

Watch the Deep Dive

I break down the full probability analysis and the specific price levels I am watching in this video:

1. The Value Signal: What the PAI Says

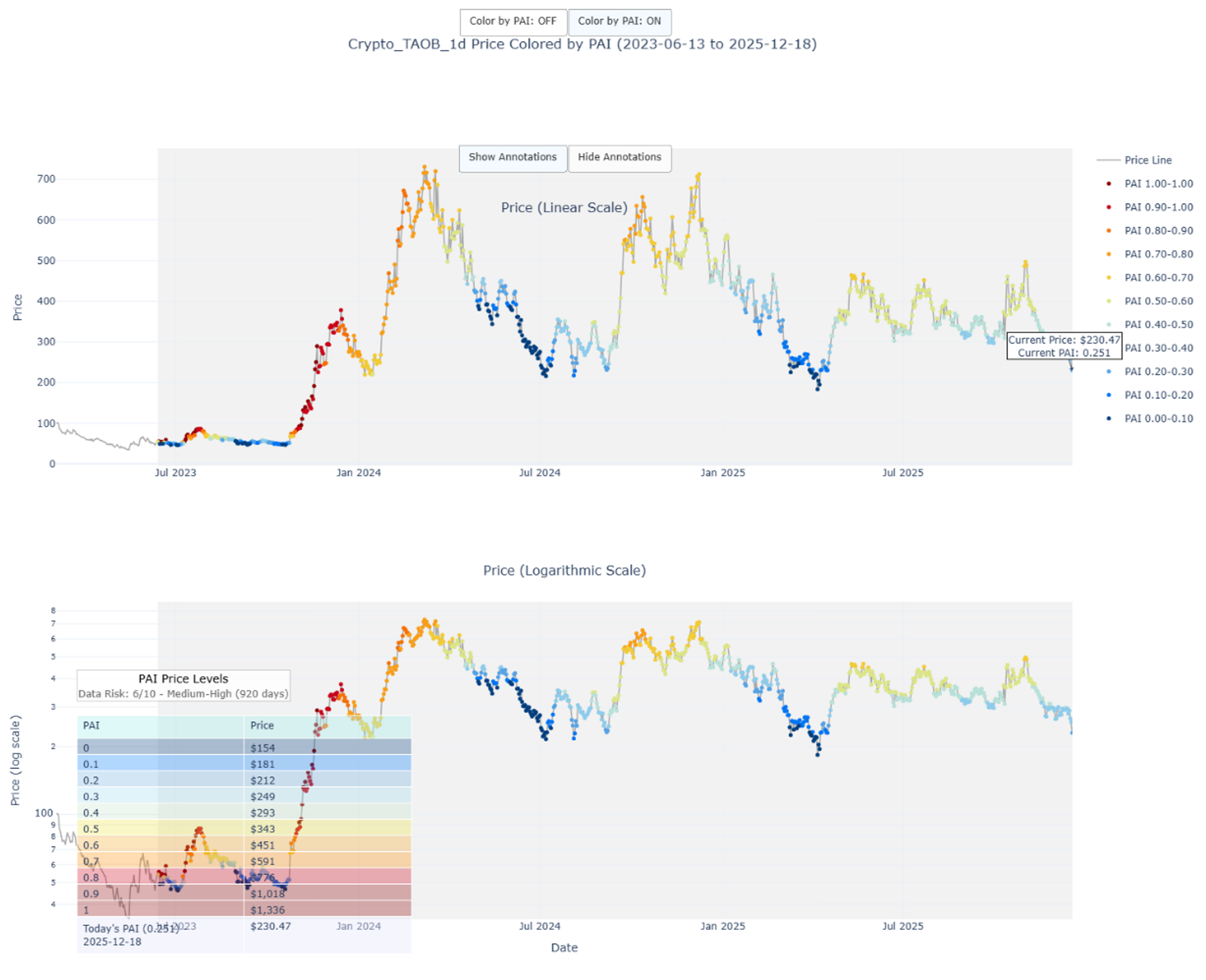

First, let's look at the raw data. The chart below shows BitTensor's price history colored by my PAI model.

- Current PAI: 0.25

- The Signal: The chart is painting "Blue." Historically, buying TAO when the PAI is in this lower quartile has yielded excellent returns.

- The Context: The model, which learns from past price action, recognizes this PAI of 0.25 corresponding to $230 level as a zone where the asset is historically oversold.

On the surface, this looks like an easy buy. But we need to look deeper at the distribution of time to understand the risk.

2. Historical Context: Is "Cheap" Actually the Bottom?

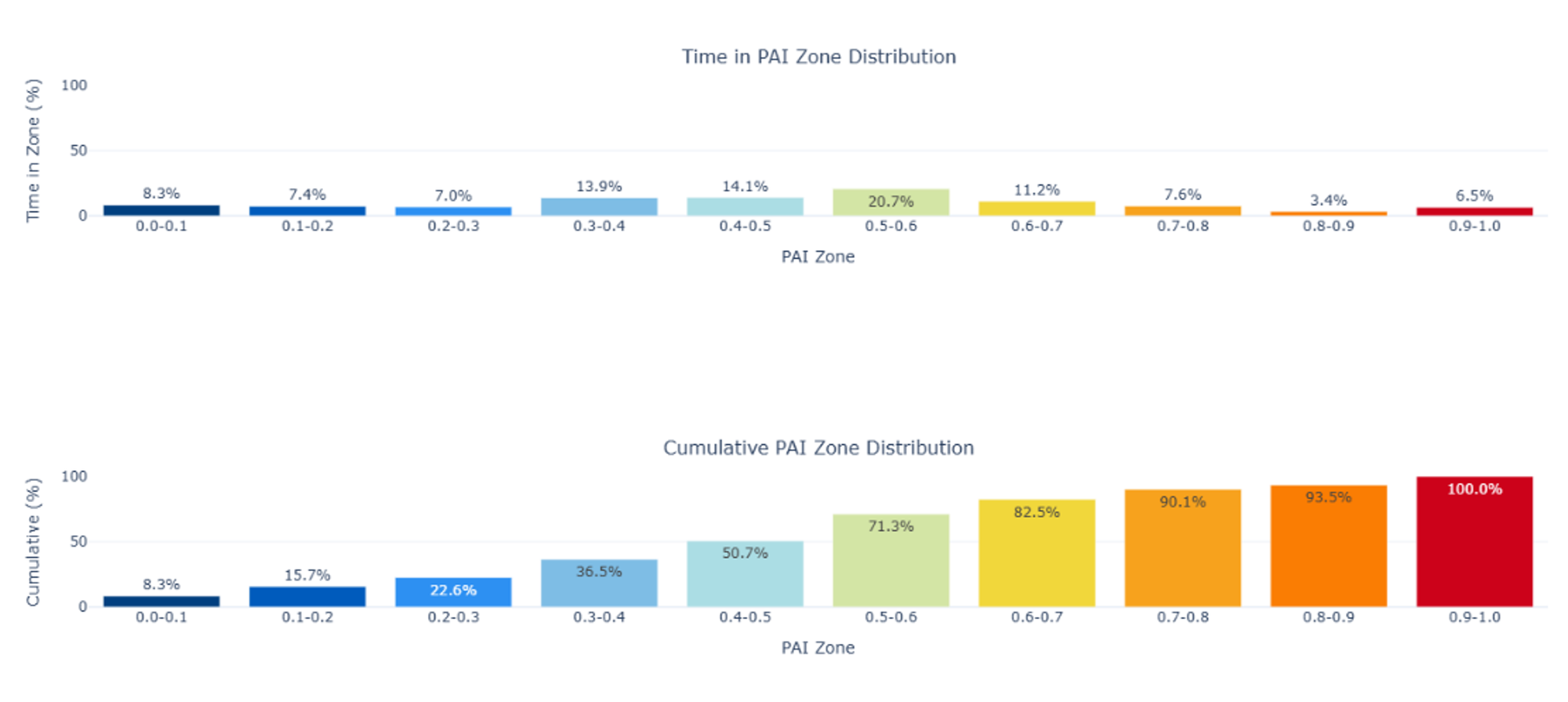

To understand if this is a true bottom or just a pit stop on the way down, we look at the Time in Zone distribution.

This data tells us a crucial story:

- Bottom 20%: TAO has spent approximately 20-25% of its history at this PAI level or lower.

- The Implication: This means that 80% of the time, the price is higher relative to its trend. That is a solid risk/reward ratio.

However, "Low" is not "Lowest."

If we look at the extreme value zones (PAI 0.0 to 0.1), we see that TAO can and does go lower. My model indicates that the absolute zero-bound floor for TAO in the current structure is likely between $150 and $180.

Buying at $230 when the potential floor is $150 represents a significant drawdown risk (approx. -30% to -35%). In a confirmed bull market, you front-run that dip. In a potential bear market, you wait.

3. The Strategy: Value vs. Momentum

Because the broader crypto market (led by Bitcoin) is showing weakness below its 350-day moving average, I am treating all altcoins—even high-quality ones like TAO—as high-risk assets.

I am essentially ignoring the current "Value" signal in favor of a "Safety" signal. I have two specific plans for entry:

Plan A: The "Generational Value" Entry (Limit Orders)

If the market capitulates and TAO flushes down to the PAI 0.0 - 0.1 zone ($150 - $180), I will consider opening a position.

- Why: At this level, the statistical probability of a bounce is overwhelmingly high. The risk/reward becomes asymmetric enough to justify catching the falling knife.

Plan B: The "Momentum Confirmation" Entry (Stop Buy)

If the price never drops that low, I will wait for strength. I am watching the 35-Day Simple Moving Average (SMA).

- Current Level: ~$292

- The Rule: I will not buy until TAO claims the 35-day SMA as support.

This is the core of the strategy: I would rather buy at $295 with a confirmed uptrend than buy at $230 while the knife is still falling. By paying a higher price, I am buying certainty and trend confirmation.

The Verdict

The AI narrative is strong, but the data says wait.

I am not interested in gambling on a bottom. I am interested in executing a system. Until TAO hits extreme value ($150 range) or confirms a trend reversal (>$292), I am sitting on my hands.

Get the Data

The charts in this article are snapshots of a dynamic system. To get my latest PAI updates, probability forecasts, and risk alerts delivered to your inbox, join the newsletter.