Bitcoin at $58k? The Generational Buy Zone -3 Independent Models Agree

As of today, February 7, 2026, Bitcoin is flirting with the $70,000 level. To the casual observer or the retail trader, this might look like a simple dip—or perhaps the beginning of the end. The market is currently filled with two types of noise: the "delusional" crowd still calling for $200k in the immediate future, and the panic-sellers claiming crypto is dead.

At The Power Law Investor, we ignore the narratives and focus on the math. My goal is to identify the mathematically and statistically validated bottom so we can deploy capital with confidence. Today, I am sharing a rare "confluence" event where three entirely independent models are triangulating on a single, generational buy zone: the $53,000 to $60,000 range.

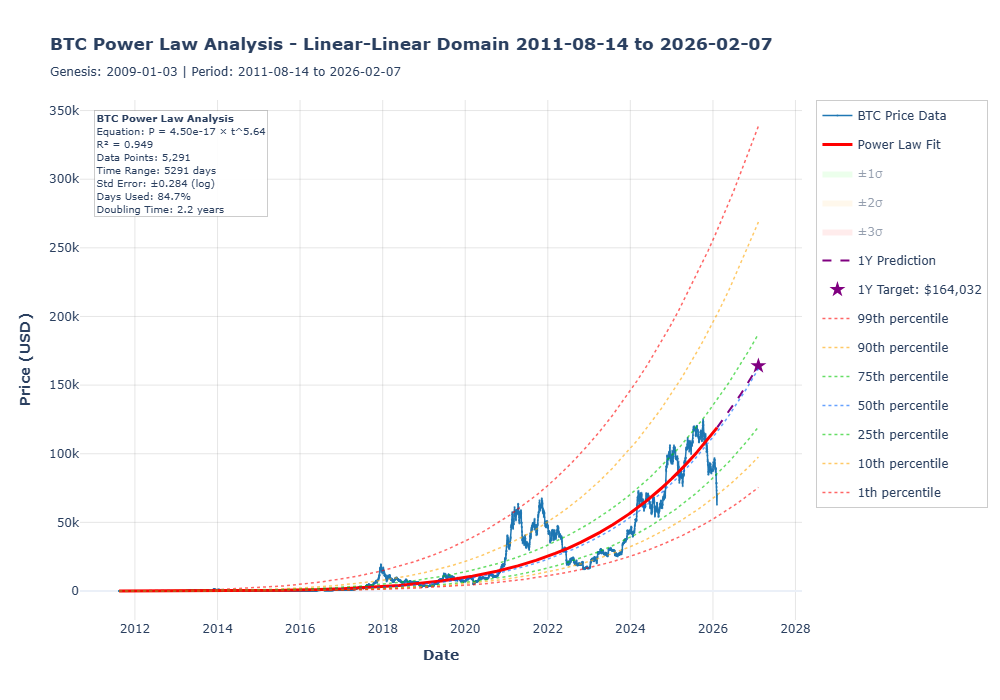

1. The Power Law: Finding the 1st Percentile

The foundation of my analysis is the Bitcoin Power Law. By plotting the price against the time since the Genesis block on a log-log scale, we find a trend line that explains roughly 95% of Bitcoin's price variation over the last 15 years.

When we translate that log-log data back to a linear scale, we get a clear "corridor" of price action. Historically, we look for the 1st percentile line—a level that represents the bottom 1% of predicted prices based on the Power Law fit.

Why this matters now: In previous cycles, we saw massive "blow-off tops" in Q4 of the halving year. However, in 2025, we topped out at roughly $125k in October—a move that only reached the 75th percentile. Because we didn't overextend to the upside, the "crash" back to reality is now finding its floor. Currently, the Power Law 1st percentile sits at approximately $54k–$55k. This line accurately called the absolute bottoms in March 2020 ($4,600) and November 2022 ($16k).

2. The Structural Support: The 200-Week SMA

While the Power Law looks at time and growth, moving averages look at structural market momentum. A key demarcator of bull and bear markets is the 50-week Moving Average (currently around $100k). Once the price crashes through that, we almost always test the deeper "mean" levels.

The "Ultimate Support": As seen in the chart above, we have already sliced through the 50-week and the 100-week SMAs. This leaves the 200-week SMA as the final structural floor. Currently, that level sits at $58,083.

Historically, while Bitcoin can briefly "wick" below the 200-week average (as it did in late 2022), it rarely stays there for long. If you are buying near $58k, you are buying at a price point that has served as the iron-clad support for Bitcoin’s entire existence.

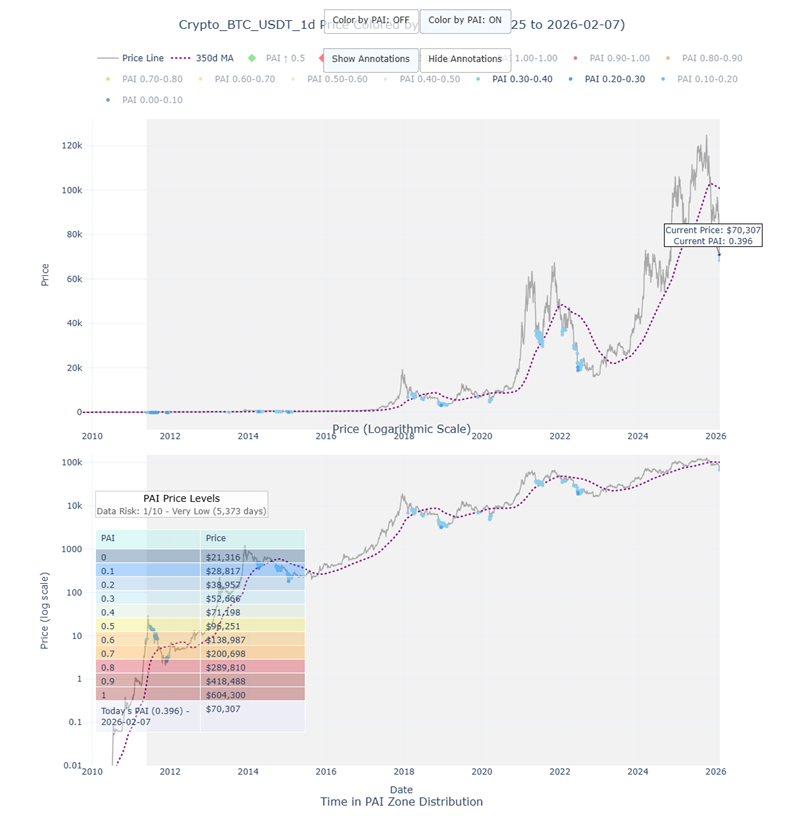

3. The PAI System: The "Blue Zone" Buy Signal

Finally, we look at my proprietary system: the Power Amplitude Index (PAI). The PAI is a normalized metric between 0 and 1 that measures price intensity.

Reading the Heat Map: The closer the PAI is to 0, the "colder" (more undervalued) the price. We focus specifically on the 0.2 to 0.3 range, which I call the "Mid Blue Zone".

- Historical Accuracy: This zone signaled the $3.1k bottom in 2018 and the $18k region in 2022.

- Current Reading: The 0.3 PAI level currently correlates to a price of $53,000.

Even if the price is below the 350-day moving average (the purple dotted line in the chart), entering when the PAI is in this deep blue region has historically been a winning strategy, regardless of broader bear market conditions.

Conclusion: How to Play the Confluence

We now have three independent, mathematically distinct models telling us the same thing:

| Model Perspective | Indicated Entry Level |

| Power Law (1st Percentile) | ~$54,000 - $55,000 |

| 200-Week SMA (Structural Floor) | ~$58,000 |

| PAI Index (Deep Blue Zone) | ~$53,000 |

The Strategy: Discipline Over Panic

While the price is at $70k today, the "Great Deal" is roughly 20% lower. My strategy is to begin heavily Dollar Cost Averaging (DCA) as the price moves below $60k.

We don't need to time the absolute bottom to the dollar. If you are buying in the $53k–$60k range, you are positioning yourself in a Generational Buy Zone. In the coming months, you will hear narratives that "crypto is dead"—ignore them. Look at the charts, trust the models, and prepare for the next cycle.